us exit tax calculation

The United States is unique however in tying its exit tax to a change in visa or citizenship status. Us exit tax calculation Monday March 7 2022 Edit.

An Expert Explains Is There Really A Nj Exit Tax

On the other hand the rule could be interpreted as an instruction for calculation of the taxable gain on the deemed sale of world.

. The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of. The expatriation date is the date an individual relinquishes US. Exit tax is a tax paid by US covered expatriates who want to renounce their US citizenship or Green Card.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. Not every US expatriate is a covered expatriate there are three tests. This is called citizenship-based taxation.

Citizenship or in the case of a long-term resident of the United States the date on which the individual ceases to be. The expatriation date is the date an individual relinquishes US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

The exit tax calculation. Covered Expatriates and the Exit Tax. This is the aggregate net value of worldwide assets.

The 9 parts are. The US Exit Tax calculation is not. Will be able to meet all requirements in three years for buyers of its.

Any appreciation in excess of 690000 as of 2015 will be subject to the exit tax. It is not just your US. What Is Form 8854 The Initial And Annual Expatriation Statement 2 Green Card Holder Exit Tax 8 Year Abandonment Rule New.

Citizens who have renounced their. In fact it does not even require that the green. Watch our Exit Tax video Part 2 to understand how to calculate the Exit Tax forms to file and some considerations after youve gone through the Exit Tax.

If a Green Card Holder has been a permanent resident for at least 8 of the past 15 years they become subject to expatriation tax laws as well. General Rule Expatriate and long-term residents. Put simply exit tax is an income tax.

Other countries have exit taxes too. Citizenship or in the case of a long-term resident of the United States the date on which the individual ceases to be a lawful. Exit taxes can be imposed on individuals who relocate to another.

For married taxpayers each spouses net worth is calculated separately from the other. Million metric tons of greenhouse emissions most recent annual data.

Irs Fud What You Need To Know About Crypto Taxes Techcrunch

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Renouncing Us Citizenship Expat Tax Professionals

Leading Edge Alliance International Tax Teleconference Director Patty Brickett International Assignment Services July Ppt Download

Doing Business In The United States Federal Tax Issues Pwc

How To Escape The Exit Tax Escape Artist

Tax Resident Status And 3 Things To Know Before Moving To Us

Tax Calculator Vanguard Charitable

U S Expatriation The U S Exit Tax

The Tax Consequences Of Renouncing Us Citizenship

United States Taxation Of International Executives Kpmg Global

Cross Border M As Post Tcja Three Things Advisers Should Know

The Taxes That Raise Your International Airfare Valuepenguin

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

%20(1).png)

How The Us Exit Tax Is Calculated For Covered Expatriates

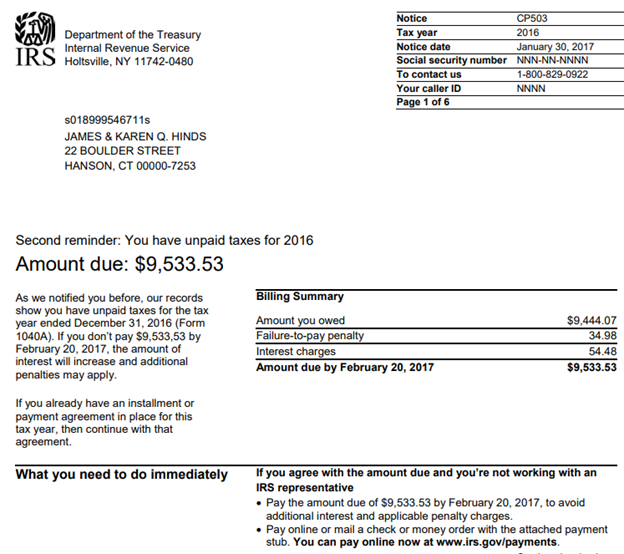

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group